Sticker Shock: Commissioners Hear Concerns About 2025 Property Revaluation

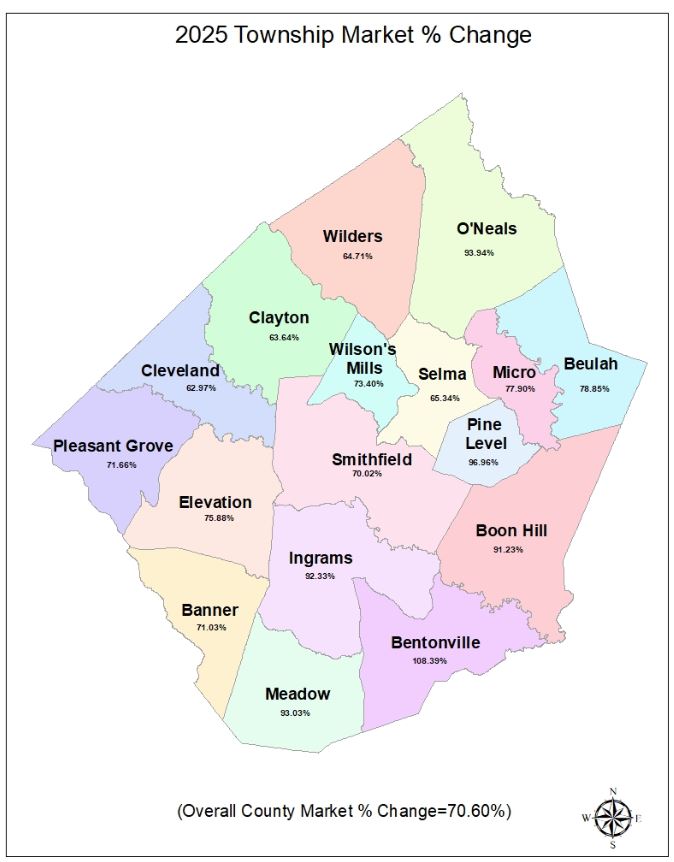

Rural areas see highest average increases

JOHNSTON COUNTY – Johnston County Commissioners heard from a number of resident on Monday who were concerned about the recent property revaluation. Revaluation letters went mailed out last week reflecting an average countywide property increase of 70.6 percent. Some residents told commissioners their values increased by 300 percent or more.

Johnston County Tax Administrator Jocelyn Andrews said the County has seen considerable growth since the last revaluation in 2019.

Under state law, property must be revalued every 8 years. In 2019, Johnston County Commissioners voted to conduct the next revaluation in 6 years (2025) and afterwards every 4 years.

Andrews said in 2019 there were approximately 100,000 parcels. That number has increased by more than 20,000 to 120,692.

Andrews said rural areas, particularly in the eastern and southern regions of the County, experienced the highest percentage increases in property values. She said the increases were not randomly assigned and are reflective of the current market in Johnston County

Andrews said property owners should appeal the new revaluation if they feel the new values are incorrect.

Commissioners heard complaints from residents countywide on Monday.

A Beulah township resident, who owns several parcels, told commissioners the revaluation process was flawed. Part of their property is gated and no one bothered to look at his land. Some of his land is adjacent to the Little River and stays flooded. His land values increased from 65 to 183 percent, included the flooded land. “People need to walk this property before they can say its gone up so much in value. They don’t need to base it on Clayton values and Flowers values.”

John Long of the Cleveland community said his home increased in value by 50 percent. He wanted to know if he would receive 50 percent more in county services this year. He stated the process places an undue burden on retirees and those on fixed incomes.

James Peedin of Pine Level was present when an appraiser went to his land last year. “When the tax person came to evaluate my property not only did they not look at the property, they stayed in the car on the highway. Now that’s not a tax evaluation.”

Mr. Peedin said his values increased by 180 percent. “That is not taking care of your county citizens.”

Teresa Jernigan of O’Neals Township, said her family has 25 acres of land originally owned by her great-grandmother that she wants to continue to pass down to future generations. Ms. Jernigan told commissioners that may be impossible due to a 300 percent increase in the value of the 25 acre parcel. “The taxes are not fair and equitable. The only people getting billed for these taxes are the ones who own something. People that rent and other things don’t have to pay these kind of taxes because they don’t own property. The tax in Johnston County is not equitable to everybody because everybody don’t have to pay. It’s hurting those of us trying to keep something in our family that’s having to pay. My father is fixing to be 89 years-old. The property has been in the family since my great-grandmother. If he has to pay the property taxes this is going to cost. He can’t afford it.”

Johnston County officials released statistics showing rural areas saw higher average increases than the fastest growing communities.

For example, the Bentonville township had the highest average increase in property values, increasing 108 percent, compared to a 63 percent increase in Clayton and 62 percent in Cleveland township.

Average Increase By Township:

Bentonville 108.39%

Pine Level 96.96%

O’Neals 93.94%

Meadow 93.03%

Ingrams 92.33%

Boon Hill 91.23%

Beulah 78.85%

Micro 77.90%

Elevation 75.88%

Wilson’s Mills 73.40%

Pleasant Grove 71.66%

Banner 71.03%

Smithfield 70.02%

Selma 65.34%

Wilders 64.71%

Clayton 63.64%

Cleveland 62.97%

It is important to note that a 70.6% increase in property value does not equate to a 70.6% increase in property taxes. Tax rates for 2025 will be set by the County and local municipalities in June, with tax bills expected to be mailed around August 1, 2025.

Property owners who wish to appeal their new property values can do so online by visiting JohnstonNC.gov/Tax.

Discover more from JoCo Report

Subscribe to get the latest posts sent to your email.

42 Comments

Comments are closed.

The county has lost their way because of the flow of Yankees to our area the people of Johnston county should have stood up before but it’s now or never !!!

Too late. Hang out your white flag.

Lost again.

The money made by selling our people’s land is going to cost us everything in the end it’s not worth it

People need to show up at the courthouse with torches and pitchforks like they use to do

We can’t get decent phone or internet service yet our property values increase the most?

It’s all part the plan. The government don’t want you to own anything. They will tax your property so high, you can’t afford and have to sell to them in the future.. All part of the control plan. I believe these people went on websites like Zillow.com and saw the value there and sent us that value for taxes.

I wish my tax value was as high as the zillow -because as it stands now, I wouldn’t sell my house for the new tax value, but I would for the Zillow value in a heartbeat.

This is what you get when you keep voting for the same people. Every single one of you who re-elected these jokers are getting EXACTLY what you voted for. #VoteOutIncumbents #ElectionsHaveConsequences

I could not AGREE with you more, Tell the Truth!!! Everyone, keep voting in the same Good ‘ole Boys!

Thank God us Liberal Progressive Swamp Loving Deep State Government County Office Heads are still in control of the Johnston County Government!!! We are going to run out these knuckle dragging Trump supporters out of this county by draining their bank accounts!!! The best part is that those so-called conservatives commissioner’s can’t do a thing about it!!! Johnston county citizens are welcomed to the DEEP STATE SWAMP!!!

This is how they make people give up their generational land. Force you to sell to make way for people or corporations who can afford it. Johnston County is being gentrified and soon it will be like Cary ,Holly Springs and Apex.

Property taxation is theft/extortion by government. “Owning” property is an incorrect term. You never really own it if you are having to keep paying for it every year. Property owners end up paying more in total property taxes, in many cases, than the original purchase price after many years’ worth of this taxation. Government and government administrators are “the mafia” in this scenario. There is NO WAY you can justify these increases in value!!!!! Plus the commissioners will never adjust the tax rate for the tax to be net neutral for the property owner. And I don’t want to hear that you can appeal the value. You can, but the constraints in the form of “valid reasons” to appeal favor the county and not the property owner. An owner with multiple parcels simply cannot pay for an appraisal for each parcel only to have his appeal denied. The deck is stacked!!! Over-taxation will become a MAJOR voting issue very soon and. ALL elected officials endorsing this extortion should be unceremoniously booted from office!!!

@Hopping: The overwhelming majority of JoCo taxpayers have elected (and re-elected) this board. What did yall expect?

Gonna take a grassroots level concerted, organized movement of JoCo property owners to keep this in front of the eyes of residents. I’m all in, but I can’t do it by myself.

“It is important to note that a 70.6% increase in property value does not equate to a 70.6% increase in property taxes.” I call BS on that.

JoCo should lower the property tax rate significantly to balance gains made from new valuations.

This whole process wreaks of mismanagement. They send out these sticker shock appraisals to everyone without first determining the new rate!? So now I have to wait until August to know how much more money my government demands me to pay them for the right to continue owning MY property? Which will be due no later than a few months after? If nothing else the commissioners should be voted out for causing mass panic when this could have been managed so much better!

Jason: The rate was set MOMTHS ago, before the election. This has been public for quite a while… and yet the sheep re-elected the board. #YouGetWhatYouVoteFor #TaxAndSpendGOP

You are incorrect. The tax rate for this year will not be set until June of this year, read the last part of the article above. The tax rate set months ago was for 2024. It’s done this way to give folks an opportunity to appeal first, however, with an increase in property assessment value this large, it was a mistake for the county to send out these notices without a clear explanation of this. Almost everyone I have talked to doesn’t understand that the rate (by law) should change so that the county ends up revenue neutral. EVERY citizen should contact their commissioner and DEMAND that the property tax income for the county remain revenue neutral, meaning a much lower rate per $1000 this year!

Your property taxes should be set when you buy a home and never increase. If you sell, the new owner can take the burden of the new tax valuation. I should not be penalized because tons of other people move here and cause the value of my home to increase. This is how older folks lose their homes. The taxes collected from newer people moving here should cover the budget.

Stop approving these new subdivisions! The developers come in, put in a new subdivision and leave with pockets full and our evaluations go up because of the new homes. We’re left with more property taxes and new schools, police, fire and road improvements that come from our pockets to cover what the developers do to us! You can’t safely travel the roads without being tailgated by someone doing twenty over or a dump truck almost running you off the road! Enough is enough! Stop trying to be like Raleigh! You’re killing the people that live here to make people that don’t care happy! Stop!

Truth-

If you look up salaries of the tax administrator and others in the county you will understand why these new values are being pushed on the public. Keep an eye on Mrs . Andrew’s salary and see how much her pay will increase for helping the commissioners push this on the citizens of the county .

Clayton has one of the highest number of homes and subdivisions. More than O’Neals. How come they are next to last?

1. If you are going to change values of land you need to actually LOOK at said land. Walk the land, look at the GIS maps for pete’s sake! Much of the land in southern JoCo (Bentontonville) is in Mill Creek watershed or Neuse lowlands. It is full of springs and/or marsh. It can NOT be built on, the land won’t perk for spetic. This land should be valued according to it’s actual worth – which is no where near what they have valued it at.

2. I know that whoever appraised our land did NOT actually WALK the freaking land or even LOOK at the GIS. Ain’t no way that “marsh out” land we have underwater in Bentonville Township is worth $15k/acre which is what these clowns have valued it at. These “appraisals” absolutely verifiy that these appraisers did not actually walk the land OR look at it in the GIS maps – because those parcels SHOW the marsh areas.

3. If a person splits their land into 2 parcels, do NOT charge residential tax rates per acre unless a building permit is issued and someone actually builds on it!

4. Remember every one of these names and let’s vote them out.

We as tax payers have the power to vote all of the corrupt county commissioners and county manager to out of office by having a partition signed by the county tax payers. Only 2/3 of the taxpayers vote is all we need to have them removed from office according to the constitution.

They have lost their way and no longer serving the constituents of Johnston County.

We to Join together to make this happen, instead of complaining about it. Who all is in favor to make this work!

Count me in. I’m set to go

The county (and cities) should Completely Do Away With Property Tax, and Increase Sales Tax! That way, a person could Acutually Own Their Property.

Property taxes are a scam. They are taxing you on something that hasn’t been sold. It has zero value until you sell it. They shouldn’t assess any taxes because the property has no monetary value. If you sell it for less than the assessed rate, you lose money. It is nothing more than legalized extortion. Feel free to let commissioners know how you feel every time you see them in public.

This is EXACTLY what Kamala Harris wanted to do. She wanted to tax people on unrealized gains and she was defeated soundly. These commissioners are all professional politicians and will lure and steal and try to convince you that they only want what’s best for you.

You – “It’s KaMAla HaRrIs and them da*n LiBeral people FauLT”

Me “rolls my eyes at you” the county commissioners are literally almost all Republicans you idiot. You what you vote for.

I didn’t say it was her fault you kook. I said it was the same thing as her wanting to tax unrealized gains. Sheesh you are dense.

Do you still think those bonds don’t raise your property taxes?

Go to the Johnston County website TAX OFFICE link. Search for your appraisal card by your name or address. Is everything on the card correct? If not, Your value could be wrong too.

But y’all keep voting for republicans as commissioners. Let me say this for the 100th time. You get what you vote for and JoCo has never had ONE SINGLE DEMOCRAT elected as a commissioner. But hey keep voting R and voting developers on lol. The definition of insanity is JoCo voters. Fools

All will be forgotten by election time and you’ll support them cuz they ‘publicans.

And the county sends a letter where you can appeal the property tax increase and it’s laughable,I appealed twice and both times the assessors came up with BS excuses of why I couldn’t get a lower rate,don’t waste your time!

People voted in good old boys who decided that Corporations don’t need to pay income tax after 2030, in order to bring jobs. We pay for the infrastructure. Johnston County pays $50,000,000 a year in interest alone,while seniors don’t have kids in school but the legislators can give out $500,000,000 million for rich people to send kids to charter schools. The county should collect taxes 2 times a year, thus reducing the interest they pay on debt. County taxes are usually paid in arrears, I believe. Need to limit growth by requiring larger lot sizes for single homes.

Interesting that joco report is pushing this story down the line even though it has by far ands away the most comments. They must have got a call from the commissioners.

NEVER RE-ELECT A SITTING MEMBER OF THIS BOARD!!!

So are county employees going to get a big raise too?

It is important to note that a 70.6% increase in property value does not equate to a 70.6% increase in property taxes. Tax rates for 2025 will be set by the County and local municipalities in June, with tax bills expected to be mailed around August 1, 2025. …… Yeah, I’m 100% sure the tax rate will go down …. remember this at election time.